can i deduct tax preparation fees in 2020

Tax preparation fees on the return for the year in which you pay them are a miscellaneous itemized deduction and can no longer be deducted. Find out what you can and cannot deduct as well as rules.

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

July 12 2020 410 PM It should be in proportion to the income generally.

. For example if your AGI is 60000 the 2. Are CPA fees tax deductible. The old tax code featured a deduction for miscellaneous expenses that included things such as unreimbursed business expenses investment fees and tax-prep fees.

For instance according to the IRS you can deduct. The fees you pay to set up a revocable trust are generally considered personal expenses which are not deductible for tax. Can you deduct accounting fees in 2019.

Unless youre self-employed tax preparation fees are no longer deductible in tax years 2018 through 2025 due to. As of 2018 and TCJA these fees are no longer. These fees include the cost of tax.

So you will not be deducted. This means that if you. SOLVEDby TurboTax5341Updated December 21 2021.

For most Canadian taxpayers the answer unfortunately is no. With the numbers given you would be able to claim around 72 of the fee as business expense or. When a Schedule K-1 is issued to a beneficiary it indicates the type and nature of the excess deduction being passed through so the beneficiary can treat the excess.

According to the National Society of Accountants the average fee in 2021 for preparing Form 1040 with Schedule A to itemize personal deductions along with a state. The IRS has provided some helpful guidance for taxpayers with Schedule C businesses. While tax preparation fees cant be deducted for personal taxes they are considered an ordinary and necessary expense for businesses.

This means if you are self-employed you can deduct your preparation and filing costs as part of your business expense deductions. Lacerte has screen 32 Other Deductions where we entered investment advisory fees and selected 2 of AGI limitation applied. From 2018 to 2025 that is no longer on the tax code because it was part of 2106.

Did you know that you can add investment fees and expenses to your miscellaneous tax deductions. However the government considers these fees to be expenses for businesses. The AGI limit means that any miscellaneous expenses you can deduct must be more than 2 of your Adjusted Gross Income.

This means if you. While tax preparation fees cant be deducted for personal taxes they are considered an ordinary and necessary expense for businesses. For example youd get no deduction for the first 2000 of fees you paid but you would be able to deduct the last 1000the amount that exceeds 2 2000 of your.

Fees that are ordinary and necessary expenses directly related to operating your business should be entered on Form. If youre looking for some extra tax relief you may be wondering if the cost of preparing your tax return is deductible. You can no longer deduct tax prep fees from your personal taxes in most cases.

Schedule C Deductions for Tax Preparation Fees and Tax Legal Fees. For example on your 2021 tax return you deduct the fees you paid to prepare your 2020 taxes. Are CPA fees tax deductible.

Accounting fees and the cost of tax prep software are only tax-deductible in a few situations. The PMI deduction had expired at the end. If youre self-employed or earned rental income accounting and tax prep software expenses are considered eligible businessrental deductions.

However the big question is how do you write off your tax preparation fees. For most Canadian taxpayers the answer. While tax preparation fees cant be deducted for personal taxes they are considered an ordinary and necessary expense for business owners.

And the answer is no not for a few more years. You can deduct all your tax preparation expenses on Schedule A.

These Free Tax Filing Options Can Keep Money In Your Pocket Time

Can You Deduct Tax Preparation Fees Find Out Here

Do You Know What Dmv Fees Are Tax Deductible Fair Oaks Ca Patch

Why Do Low Income Families Use Tax Preparers Tax Policy Center

Tax Deductions For Rideshare Uber And Lyft Drivers And Food Couriers Get It Back

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Are Tax Preparation Fees Deductible

Investment Expense Tax Deduction Which Fees Can You Deduct

Are Medical Expenses Tax Deductible

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

H R Block Review 2022 Pros And Cons

How The Tcja Tax Law Affects Your Personal Finances

Is The Irs Forgiving Some Late Filing Fees Because Of The Pandemic 11alive Com

What Are Itemized Tax Deductions Turbotax Tax Tips Videos

Publication 502 2021 Medical And Dental Expenses Internal Revenue Service

/tax_prep_business-5bfc3aafc9e77c00587b0d6e.jpg)

What Will I Pay For Tax Preparation Fees

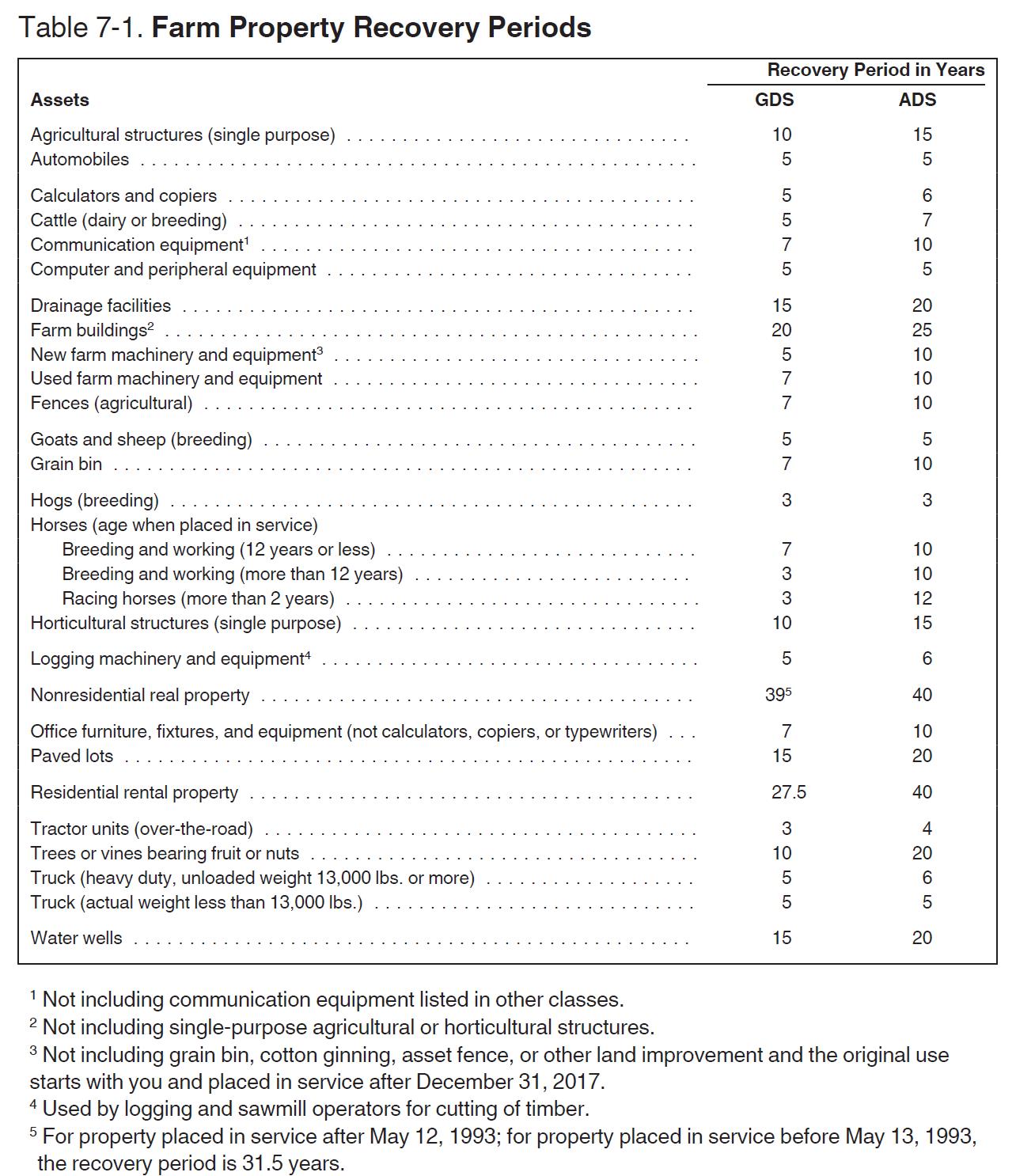

Deducting Farm Expenses An Overview Center For Agricultural Law And Taxation

Are Estate Planning Legal Fees Deductible From Your Taxes

Can I Deduct Legal Fees On My Taxes Turbotax Tax Tips Videos